Unbundling the corporation

The forces that fractured the computer industry are bearing down on all industries. In the face of these changes, companies must ask themselves: what business are we in?

In the late 1970s the computer industry was dominated by huge, vertically integrated companies such as IBM, Burroughs, and Digital Equipment. With their vast advantages of scale and huge installed base of users, these companies seemed to be unassailable. Yet just ten years later, power in the industry had shifted: the behemoths were struggling to survive while an army of smaller, highly specialized companies was thriving. What happened?

The industry’s transformation can be traced back to 1978, when a then-tiny company, Apple Computer, launched the Apple II personal computer. The Apple II’s open architecture unlocked the computer business, creating opportunities for many new companies that specialized in producing specific hardware and software components. Immediately, the advantages of the generalist—size, reputation, integration—began to wither. The new advantages—creativity, speed, flexibility—belonged to the specialist.

The story of the computer industry illustrates the crucial role that interaction costs play in shaping industries and companies. These costs represent the money and time expended whenever people and companies exchange goods, services, or ideas.1 The exchanges can occur within a company, among companies, or between a company and a customer, and they can take many everyday forms, including management meetings, conferences, phone conversations, sales calls, reports, and memos. In a real sense, interaction costs are the friction in the economy. Taken together, they determine the way companies organize themselves and form relationships with other parties. All else being equal, a company will organize in whatever way minimizes overall interaction costs.

Apple’s open architecture sharply reduced interaction costs in the computer industry. By conforming to a set of well-documented standards, specialized companies could, for the first time, work together easily to produce complementary products and services. As a result, tightly coordinated webs of companies—such as Adobe Systems, Apple, Intel, Microsoft, Novell, and Sun Microsystems—could form and ultimately compete effectively against the entrenched, vertically integrated giants. Many of the new companies grew very large very quickly, but they never lost their focus on specialized activities.

The moral of the story is that changes in interaction costs can cause entire industries to reorganize rapidly and dramatically. Today, that fact should give all managers pause, for the world economy is on the verge of a broad, systemic reduction in interaction costs. Electronic networks, combined with powerful PCs, are permitting companies to communicate and exchange data far more quickly and cheaply than ever before. As business interactions move on to electronic networks such as the Internet, basic assumptions about corporate organization will be overturned. Activities that companies have always believed to be central to their businesses will suddenly be offered by new, specialized competitors that can do those activities better, faster, and more efficiently. Executives will be forced to ask the most basic and discomfiting question about their companies: what business are we really in? The answers will determine their fate in an increasingly frictionless economy.

One company, three businesses

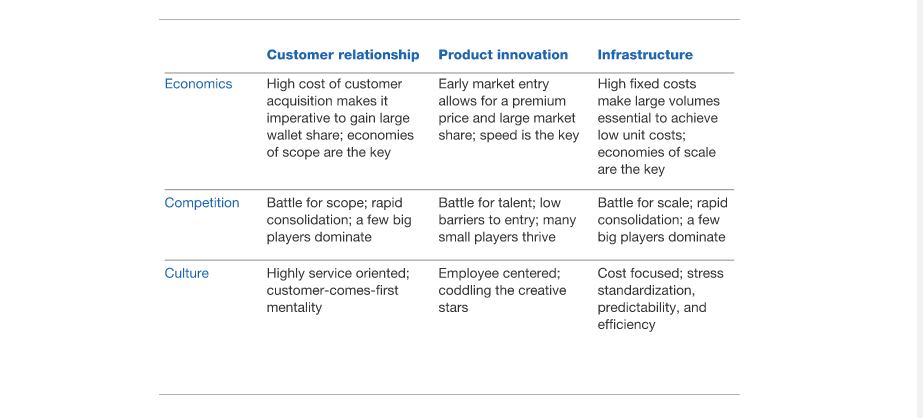

Beneath the surface of most companies are three kinds of businesses—a customer relationship business, a product innovation business, and an infrastructure business. Although organizationally intertwined, these businesses differ a great deal (exhibit).

Exhibit

Rethinking the traditional organization

The role of a customer relationship business is, obviously, to find customers and build relationships with them—for example, the marketing function of a bank or a retailer’s focus on drawing people into its branches or stores. Another set of employees—loan officers or store clerks, perhaps—assists customers and tries to build personal relationships with them. Still other employees may be responsible for questions and complaints, processing returns, or collecting customer information. Although these employees may belong to different organizational units, they have a common goal: to attract and hold on to customers.

The role of a product innovation business is to conceive of attractive new products and services and figure out how best to bring them to market. In a bank, employees in various product units or in a centralized business development function are responsible for researching new products (such as reverse mortgages) and ensuring that the bank can bring them to market successfully. In a retail business, buyers and merchandisers perform the product innovation role, constantly searching for interesting new products and effective ways of presenting them to shoppers.

The role of an infrastructure business is different again: to build and manage facilities for high-volume, repetitive operational tasks such as logistics and storage, manufacturing, and communications. In a bank, the infrastructure business builds new branches, maintains data networks, and provides the back-office transactional services needed to process deposits and withdrawals and present statements to customers. For retailers, the infrastructure business constructs new outlets, maintains existing outlets, and manages complex logistical networks to ensure that each store receives the right products at the lowest possible cost.

These three businesses rarely map neatly to a corporation’s organizational structure. Rather, they correspond to what are popularly called “core processes”—the cross-functional work flows that stretch from suppliers to customers and, in combination, define a company’s identity.

Managers talk about their key activities as “processes” rather than as “businesses” because, with rare exceptions, they assume that the activities ought to coexist. Almost a century of economic theory underpins the conventional wisdom that the management of customers, innovation, and infrastructure must be combined within a single company. If those activities were dispersed to separate companies, the thinking goes, the interaction costs required to coordinate them would be too great.

Working from that assumption, large companies have in recent years spent a lot of energy and resources reengineering and redesigning their core processes. They have used the latest information technology to eliminate handoffs, cut waiting time, and reduce errors. For many companies, streamlining core processes has yielded impressive gains, saving money and time and giving customers more valuable products and services.

But managers have found that there are limits to such gains. Sooner or later, companies come up against a cold fact: the economics governing the three core processes conflict. Bundling them into a single corporation inevitably forces management to compromise the performance of each process in ways that no amount of reengineering can overcome.

Take customer relationship management. Finding and developing a relationship with a customer usually requires a big investment. Profitability hinges on achieving economies of scope—extending the relationship for as long as possible and generating as much revenue as possible from it. Only by gaining and retaining a large share of a customer’s spending can a company earn enough to offset the up-front investment. Thus, customer relationship businesses naturally offer customers as many products and services as possible, which requires an intensely service-oriented culture.

Contrast that kind of business with a product innovation business, in which speed, not scope, drives the economics. The faster an innovation business moves a product or service from the development shop to the market, the more money the business makes. Culturally, product innovation businesses concentrate on serving employees, not customers. They do whatever they can to attract and retain the talent needed to come up with the latest and best product or service. They reward innovation, and they try to minimize administration.

If scope drives customer relationship businesses and speed drives innovation businesses, scale is what drives infrastructure businesses. Such businesses generally require capital-intensive facilities, which entail high fixed costs. Since unit costs fall as scale increases, pumping large amounts of product or work through the facilities is essential for profitability. As a result, the culture of infrastructure businesses reflects a one-size-fits-all mentality that abhors all customization and special treatment.

The regional Bell operating companies (RBOCs)—local telephone carriers in the United States—provide a good example of how these tensions can play out. An RBOC’s retail telephone operation is a customer relationship business; it focuses on acquiring customers and keeping them happy. By contrast, the wholesale telephone operation is an infrastructure management business; it maintains the RBOC’s physical communications facilities and furnishes specialized support services such as network management. To maximize economies of scale, the RBOCs could lease their wholesale facilities to telephone service resellers, which focus on the customer relationship business. But the telephone companies are wary of entering into such alliances because they fear that resellers will drain customers away from their own retail telephone businesses.

RBOCs have, in other words, deliberately limited the growth and profitability of their infrastructure businesses to protect their customer relationship businesses. That decision has encouraged specialized infrastructure businesses, which operate their own fiber-optic networks, to enter the competitive fray in metropolitan areas, creating a further threat to the RBOCs.

Most senior managers make such compromises because they believe, or assume, that they have no option. How, after all, can a core process be removed from a company without somehow undermining its identity or destroying its essence? Such a mind-set, though historically justified, is now becoming increasingly dangerous.

Organizational fault lines

Under the pressures of deregulation, global competition, and advancing technology, a number of industries are already fracturing along the fault lines of customer relationship management, product innovation, and infrastructure management. The newspaper industry is one. Not so long ago, all three core processes were tightly integrated within most newspapers. A paper took on full responsibility for attracting its customers (both readers and advertisers) and for developing most of its product (that is, the news stories presented in its pages). A paper also managed an extensive infrastructure, printing its editions on its own presses and distributing them with a fleet of its own trucks.

Today the industry is beginning to look very different. Much of the typical newspaper’s product is outsourced to specialized news services; an average newspaper depends heavily on wire services, syndicated columnists, and publishers of specialty magazine inserts for the words and images filling its pages. In addition, many newspapers aspire to shed their scale-intensive printing facilities and to rely instead on specialized printers to produce the paper each day. As newspapers move away from product innovation and infrastructure management, they can concentrate on the customer relationship portion of the business, helping to connect readers and advertisers. The Los Angeles Times, among other papers, is creating special sections, geared to particular regions or interests, that help advertisers target specific sets of readers more accurately. Such unbundling is making the newspaper business less capital-intensive, a development that permits more resources to be devoted to building customer relationships.

An influx of specialized companies has also begun to reshape the pharmaceutical industry. Some product innovators in biotechnology, notably Amgen, Genentech, and Myriad Genetics, are focusing on specific techniques such as gene mapping. Others, including Medicis Pharmaceutical and Bausch & Lomb, are concentrating on specific disciplines—dermatology, for instance. Larger drug companies, rather than financing product development efforts in all these areas, are taking equity stakes in or allying with such niche players. Roche Holding, for example, has purchased over two-thirds of Genentech, and Merck has entered into a collaborative research and licensing agreement with Aurora Biosciences. On the infrastructure side of the business, big drug companies have begun to outsource the planning and execution of large-scale pharmaceutical trials to contract research organizations such as Quantum. And big distribution specialists, including McKesson and Cardinal, now warehouse and deliver most drugs.

As these and other industries have yielded to the pressures of unbundling, established companies have faced a series of hard choices. They have had to rethink their traditional roles and identities, to challenge their organizational assumptions, and, in many cases, to make fundamental changes in the way they operate. Now, as electronic commerce reduces interaction costs throughout the economy, more and more companies will face equally tough, if not tougher, decisions.

Organization and the Internet

To see into the future of business organizations, you need only look at how Internet companies are organizing today. Portal businesses such as Yahoo! increasingly focus on managing customer relationships, relying on other companies to provide innovative products and services based on the World Wide Web, on the one hand, and infrastructure management, on the other. Many people still think of Yahoo! as a search engine, but in fact its searching product is provided by another company, Inktomi, an innovator whose expertise in parallel computing enables its engine to search millions of Web pages almost instantly. Yahoo!, meanwhile, has forged relations with big Internet-access providers, such as AT&T, that manage a large portion of the Internet’s infrastructure. Yahoo! can thus concentrate on attracting customers, gathering data on them, and connecting them with both advertisers and merchants. It is positioned to become what we call an “infomediary”—a company whose rich store of customer information permits it to control the flow of commerce on the Web. Because electronic commerce has such low interaction costs, it is natural for Web-based businesses to concentrate on a single core activity—managing customer relations, product innovation, or infrastructure management. Not that all current Internet companies are pure players. We would argue, though, that hybrid models are transitional, required by the infancy of electronic commerce. As the Internet industry matures, mixed models will become less attractive and less sustainable.

As electronic commerce spreads out into other, more traditional industries, they too will begin to fracture. Take the automotive business. Small, entrepreneurial companies, such as Autobytel.com and Autoweb.com, have recently emerged on the Web and are already gaining control over customer relationships. These companies’ sites provide car buyers with a broad range of information about current models and pricing. The sites then collect detailed data about the customers and their preferences and use that information to refer customers to appropriate automobile dealers. In 1997 Web site referrals accounted for about 2 percent of all nonfleet new-car sales—a small percentage but one representing 300,000 cars, or $6 billion in revenue. And J. D. Power & Associates predicts that one-third of all new-car buyers will purchase cars using the Web by the year 2000.

As infomediaries gain further control over customer purchases and, more important, over customer information, car companies will have to rethink the role of the traditional automobile dealer. Dealers could give up their customer relationship business entirely and focus narrowly on the infrastructure business (managing showrooms, for example), while independent, on-line infomediaries take over the role of acquiring and managing customer relationships. Car manufacturers, meanwhile, may decide—or be forced—to unbundle their businesses, outsourcing the role of customer relationship management to an infomediary, increasing the proportion of manufacturing they outsource to subcontractors, and focusing on product innovation. As infomediaries develop a deeper understanding of each customer, they could play an ever more central role in determining which make and model a customer buys, eventually coming to fulfill virtually all of a customer’s car-related needs.

A road map for unbundling

Although industries will fracture, they won’t necessarily break into many small pieces. In fact, the structure of only one of the three businesses—product innovation—is likely to be characterized by large numbers of small businesses competing on a level playing field with low barriers to entry. The product innovator’s need to provide a fertile environment for creativity tends to favor smaller organizations, as does its need for speed and agility in bringing products to market.

The other two businesses will probably consolidate quickly as a small number of large companies assume dominance. Since economies of scope are necessary in the customer relationship business, it is likely that only a few big infomediaries will survive. America Online’s decision to acquire Netscape, with its popular Netcenter Web portal, provides strong evidence that the consolidation of this business is well under way. Similarly, in the infrastructure business, economies of scale create irresistible pressures to form large, focused enterprises.

Once a company decides where it wants to direct its energies, it will probably need to divest other businesses. That will be a big challenge. Few senior managers of large companies have ever attempted a systematic divestiture program; such divestitures as have occurred have usually been spin-offs of recent acquisitions whose expected synergies never materialized. Even AT&T’s highly publicized divestiture of its computer and telecommunications equipment businesses, NCR and Lucent, respectively, falls largely into this category. The closest most companies have come to the kind of divestiture we are talking about is the establishment of outsourcing relationships in which infrastructure management activities such as logistics, manufacturing, or data processing are contracted to outside providers.

Divestiture is, of course, a radical step. In most cases, executives would need to perceive a significant and immediate threat before considering such aggressive surgery. For that reason, the first divestiture programs will probably be launched by computing, telecommunications, media, and banking companies whose markets are undergoing major technological or regulatory change. Companies in other industries will be able to learn from the successes—and mistakes—of these pioneers.

If a company has chosen to compete in customer relationship or infrastructure management, where size matters, divestiture won’t be enough; such a company will also need to build scope or scale through mergers and acquisitions. Each acquired company will probably have to go through a similar process of unbundling—shedding unneeded businesses to help finance the next wave of acquisitions and integrating the remaining businesses into the existing operation. The secret of success in fractured industries is not just to unbundle but to unbundle and then rebundle, creating a new organization with the capabilities and size required to win.

Rebundling will be a very different process from the vertical integration that has often characterized traditional acquisition programs. Because companies will be focusing on a single activity—relationship management or infrastructure management—their acquisitions will be aimed at achieving horizontal integration. They will seek to build scope or scale within their own industry and then to leverage their capabilities across related ones.

Senior managers will face many painful decisions as they make the wrenching changes needed to realign their businesses. Although the choices may be difficult, time will probably be short. Once interaction costs begin to fall, an industry can reorganize remarkably quickly—as did the computer industry. Sources of strength can turn into sources of weakness almost overnight, and even the most successful company can swiftly find itself in an untenable position.

Source: mckinsey