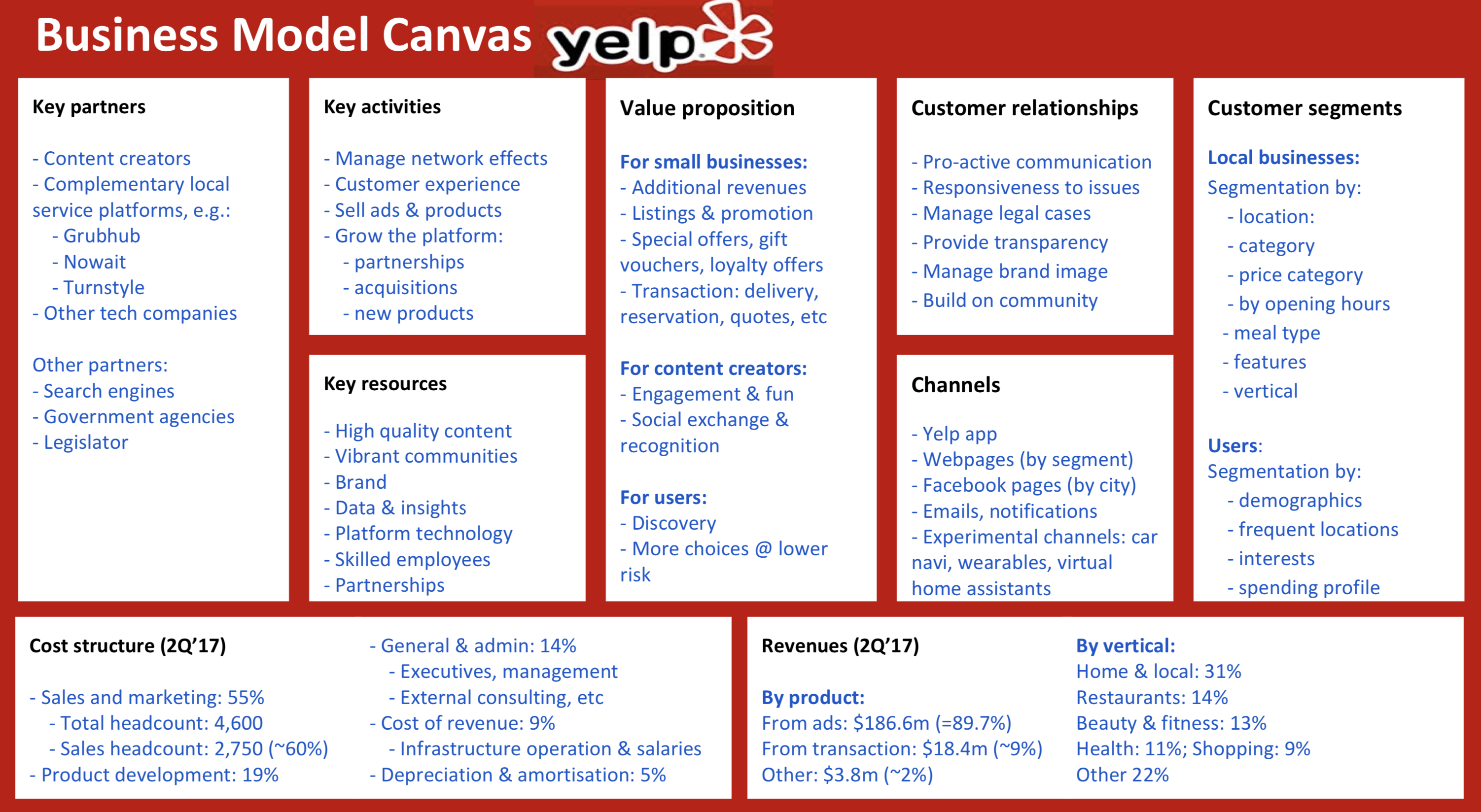

Learn how their business model works in-depth using the Business Model Canvas from one of their most successful ones: Yelp.

With

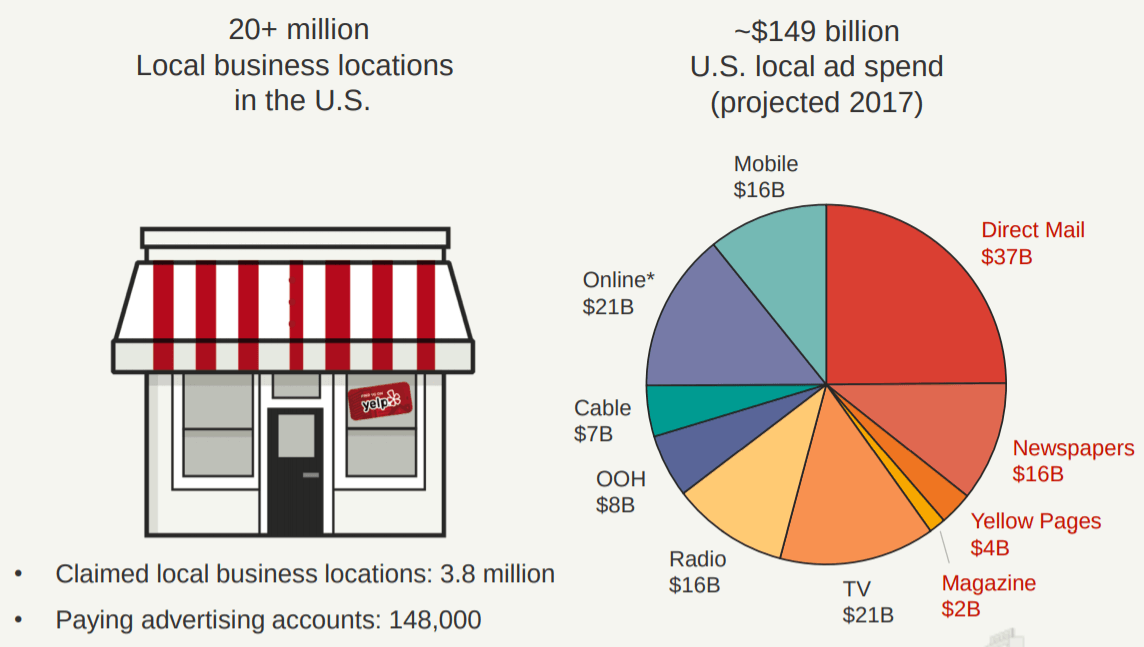

- 157.7m monthly unique visitors,

- 127.5m total reviews,

- US$713 million annual revenues and

- a market capitalisation of $3.2b,

Yelp is one of the largest user-generated review platforms.

Unlike Uber and Airbnb, Yelp had their IPO in 2012 and is now a public company. This gives us access to their annual reports which have lots of hard data on the platform business model. Join me for an exciting discovery of Yelp’s business model and that of directory / review businesses in general.

What does Yelp do?

“Yelp connects people with great local businesses by bringing “word of mouth” online and providing a platform for businesses and consumers to engage and transact.” Yelp annual report.