The platform business model is relevant for startups, young companies and established companies. For startups, it poses the opportunity to capture a share of established markets and grow large fast. But established companies too can use it with vast success. Apple is the best example. A portion of their iPod’s and iPhone’s success is based on the fact that they have used the platform business model. Prior to these two products the company was floundering for more than a decade.

The Platform Business Model

I have covered this business model extensively over the last few weeks. Now, you are getting a comprehensive summary. These are all the elements of the platform business model you will learn about today.

- What is a platform business?

- Types & examples

- Value creation & value capture

- Economic value-add

- Network effects

- Transaction costs

- Search costs

- Strategy

- Critical mass

- Engagement

- Design

- Revenue models

What is a platform business?

Let’s first be clear what we are talking about: not every technological platform is a platform business.

- E.g. Microsoft Xbox, gaming consoles, app stores are technology platforms that arebased on a platform business model.

- Amazon Web Services is a technology platform that is not based on a platform business model.

Google, Facebook, YouTube, Airbnb, Uber, eBay, Alibaba, PayPal make use of the platform business model. In this article, I use the terms “platform business model,” “platform business” and “platform” interchangeably. Economists also call them multi-sided platforms (MSP).

Professor Andrei Hagiu describes Multi-sided platforms (=platform businesses) as:

“Multi-sided platforms (MSPs) are technologies, products or services that create value primarily by enabling direct interactions between two or more customer or participant groups.”

But who are the participant groups? Well, depends on the platform. In most cases, it helps to distinguish between supply and demand side.

- Supply side: seller, service provider, host, content creator, etc

- Demand side: buyer, service seeker, guest, consumer, etc

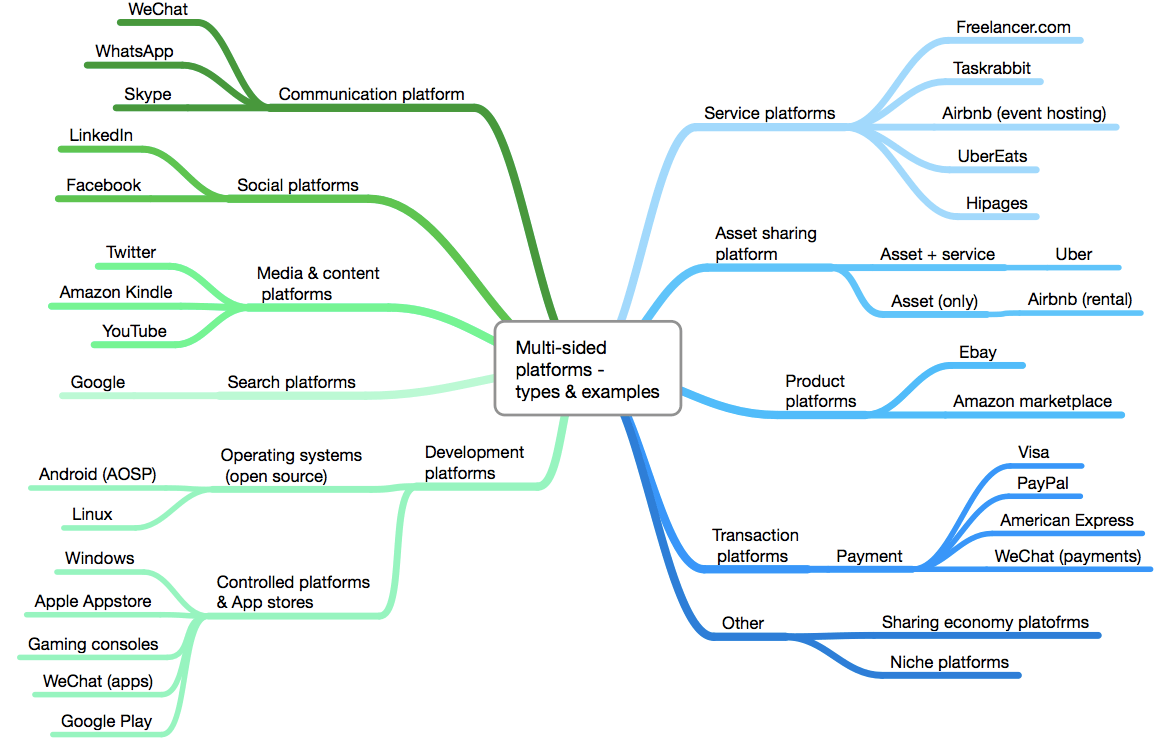

Types & examples of platform businesses

Value creation and value capture

Platforms help to sell products or services, to generate content and so on. But the platform owner as such does not manufacture the products that get sold (e.g. Ebay, Alibaba). They do not provide the services that get offered on their platform (e.g. Freelancer, Taskrabbit, Uber, Airbnb). They do not create the content that gets generated each day (Facebook, Twitter, YouTube).

So, how do they create value? Some say they are modern middleman. But that is far from complete. They need to add additional value to the overall exchange – and still be able to extract value – in order to be relevant. Many platforms have been struggling because they have not been able to do this. Here are some examples how platforms create value for their participants and capture value for themselves:

- Asset sharing platforms (e.g. Airbnb) create value:

- Help the supply side (home owners/hosts): to increase utilisation of their existing assets (unit/room/house) in order to generate additional income or to get more yield out of those than through other ways.

- Help the demand side (travellers): find cheaper, more individual, less “clinical” accommodation. And to find accommodation at peak times (e.g. when special events are on) when all hotels are booked out.

- Airbnb captures value by charging a percentage on each booking. On the surface, they are being compared to the large hotel chains but on their balance sheet, they look much more similar to an online travel portal. They don’t need to worry about financing their lodging inventory. By comparison, hotels chains design, build and own a large amount of their real estate. Not only are they subject to the whims of the commercial real estate cycles but also does it take much longer and more capital to ramp up their supply (and write-offs/impairments in downturns). (Though in good times, commercial real estate opens a lot of financial engineering opportunities because it is excellent collateral.)

- Social, media and content platforms (e.g. Facebook), encourage exchange with friends through the creation of user-generated content:

- The supply side: From a monetisation perspective, the supply side are the users (you, me and 1.5b others). We are creating user-generated content. Facebook doesn’t charge their users anything. But they use this content to analyse it and place (targetted) advertisements. By comparison, traditional media outlets, such as newspapers, hire journalists to create content among which they place their ads. You and I (and 1.5b other users) create the content for Facebook.

- The demand side: are advertisers (from a monetisation perspective). They are able to run more targetted ad campaigns compared to traditional media. They get access to an audience that is highly engaged because of the updates from friends and family that they care about.

- Facebook extracts value by giving advertisers the possibility for highly targetted ads (and for getting access to the Facebook audience in general). By voluntarily sharing our posts, our data and our likes, we give Facebook around 2000 data points about us (demographics, income, education, interests and many other things). Facebook’s advertisers can thus use their money to advertise in a more targeted ways than traditional (broadcast) channels allow.

- Facilitate the exchange of goods and services (e.g. Ebay):

- The supply side (sellers, online merchants): are composed of individuals that sell pre-owned stuff, online merchants, small businesses, etc. They derive value from getting started easily, save on advertising, be able to use Ebay’s legal and commercial framework and their payments platform Paypal.

- The demand side (buyers): can buy comfortably, have one starting point for their shopping queries, know they get things cheaply as many sellers don’t have the overhead of brick-and-mortar stores, have a buyer protection framework by Ebay and so on.

- Ebay extracts value by charging by transaction. The benefits they offer to both sides allows them to do so (though they also face the problem that participants may take their transaction outside of the platform). They do all this at much lower capex and overhead costs. They don’t hold any inventory themselves, let alone develop/manufacture any products. Like malls, they offer agglomeration benefits. And they don’t face location-specific risks that has turned a large amount of malls into (well-documented) dead malls.

Economic value-add

The business model has to add value to the individual participants. But it also has to have enough economic benefits as a whole in order to be able to be relevant.

Let’s look at Uber. One economic benefit is that it helps to utilise better idle-sitting assets.

- Average cost of ownership per year in the US: $8,558 ($23 / day)

- Cars are utilised only 5% of the time (72 mins/day) and parked 95% of the day

On an aggregate level, in 2015 this has led to economic benefits of:

- “$2.9 billion in consumer surplus in the four U.S. cities included in our analysis.” [Cohen, et al., pdf] This is for the four cities of Chicago, Los Angeles, New York, and San Francisco. Based on this they estimate a consumer surplus (=economic benefits) of $6.8 for the US in 2015 alone.

There are several other economic savings associated with Uber. E.g. in Australia a Productivity Commission came to the conclusion that taxi plates (costing the taxi owner somewhere between $200,000-$300,000 depending on the location) translate into

- an increase in fares of $1.47 for a standard 8km trip. In return for no benefit for the consumer.

The Commission states clearly that the regulations are not in the public interest (this was in 1999 and yet nothing much has changed, though since Uber has entered the country discussion may have been invigorated). ‘The public or consumer interest has suffered an estimated $20.67 million annual loss of wealth in 1993 [this refers to the city of Brisbane only], while between $11 million and $19.1 million of this loss has been picked up by the politically powerful licence holder lobby and between $1.48 million and $9.55 million has been lost to society with no group directly benefiting [the deadweight loss]’.

Don’t confuse this section with the economic value add metric (EVA) known in accounting. We are talking about an assessment of the market opportunity. Admittedly, this will always be a stab in the dark when you do it before you start. But even a crude assessment with an optimistic and a pessimistic case is better than skipping any economic assessment altogether.

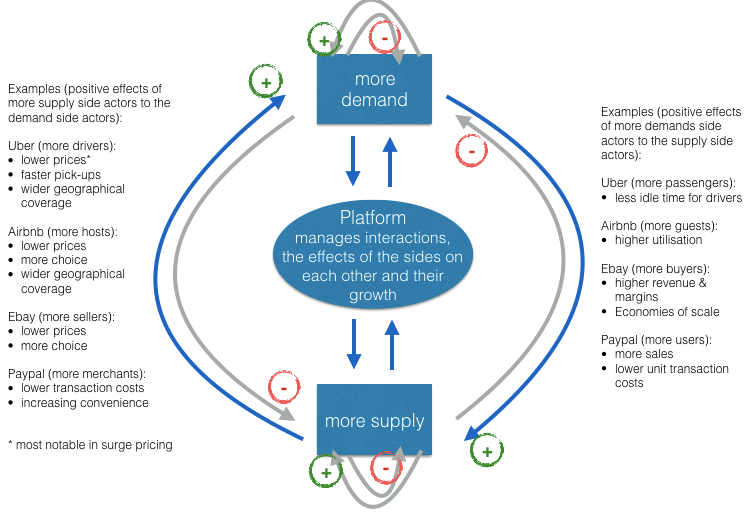

Indirect network effects

Every business model and industry has its own set of important business management concepts. Many traditional businesses, for example, optimise integrated supply chains and manufacturing processes (and supply side economies of scale). For the platform business model, the concept of network effects (also called demand-side economies of scale) is of utmost importance.

Network effects are the effects that incremental participants (and participation) have on the value of the network to other participants.

In the context of multi-sided platforms (=platform businesses), it is essential to realise that we distinguish between two different types of effects:

- Direct network effects: If only a few of your friends were on Facebook, then its value for you would be low. But as the number of users increases so does the value of the network for you and other users. They are essential for social media platforms*. Direct network effects, also called same-side network effects, are the effects of participants on one side of the network on other participants on the same side of the network.

- Indirect network effects are effects of one type of participant on other types of participants. Take Uber. Drivers and passengers are on different sides of the platform. Uber would create very little value for a passenger if there were hardly any drivers. Waiting times would be frustratingly long. Equally, for drivers, the platform would have little value without a sufficient number of riders. Idle times for drivers would make render the platform of little value. The value of the network increases with the number of cross-side participants (participation). Indirect network effects are also called cross-side network effects.

Both direct and indirect network effect can be positive (value-enhancing) or negative (value-diminishing).

Platform businesses enhance positive network effects (those spurring value) and try to mitigate negative ones (those that diminish the value of the network to others, hence slow down value). For the success of a platform, all same/cross-side effects need to be taken into account and managed accordingly.

And to complete the picture here, it is prof Hagiu who warns of over reliance on network effects.

* Some economist are presenting this as indirect network effects. They say that writers are on the other side than readers. Such a distinction may make sense on platforms where there is a considerable distinction between writers and readers (e.g. Wikepedia, Medium). But on social networks where basically everybody is both roles all the time, this distinction is too theoretical. Additionally, same economists see telephone participants as on the same side of the phone network without distinguishing between callers and call receivers. We can safely consider ordinary users on social media as on the same side.

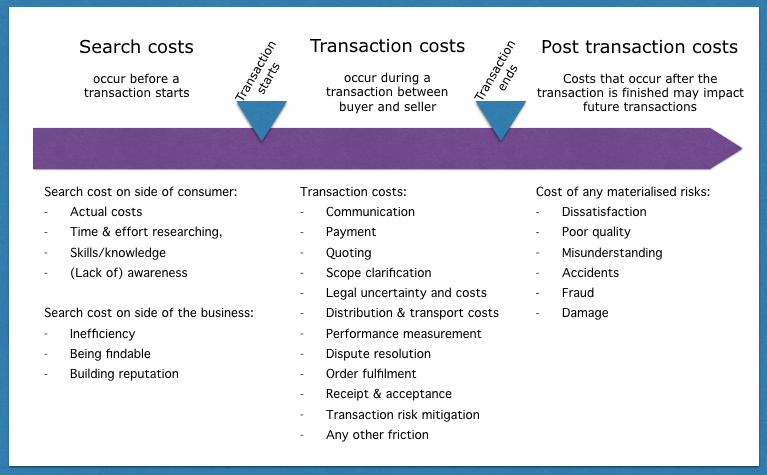

Transaction costs

Platforms make transactions cheaper and simpler. Citing Professor Andrei Hagiu again:

“At the most fundamental level, there are two types of basic functions that [platforms] can perform:

- reducing search costs, incurred by the [platform’s] multiple constituents before transacting,

- and reducing shared costs, incurred during the transactions themselves.

Any feature or functionality of a [platform] falls into either of these two fundamental types.”

Now, economists, like prof Hagiu, have a much wider understanding of these terms. But from a business management perspective, the below is a great starting point. I have added post transaction costs. These occur infrequently but in people’s mind, they are powerful barriers to entering transactions.

Search costs matter

One key characteristic of the platform business model is the reduction of search cost for its participants. Search costs can mean a lot of things, including having to spend time and effort. Platform businesses reduce search costs almost by existence. If you want to buy something online, you know you can jump on eBay and most likely find what you are after. Chances are you have not of the sellers you are going to buy from. Same holds true for the seller. For them it might be very difficult, to get found in the wilderness of the internet. But once they join eBay, they know that this platform aggregates search for online purchases.

When the demand side searches, the results can be executed and displayed in a rather crude way. Based on keywords, location or ratings. The early platforms like Craiglist can do this as well. But more advanced platform businesses constantly improve their search and matching algorithms in order to add more value.

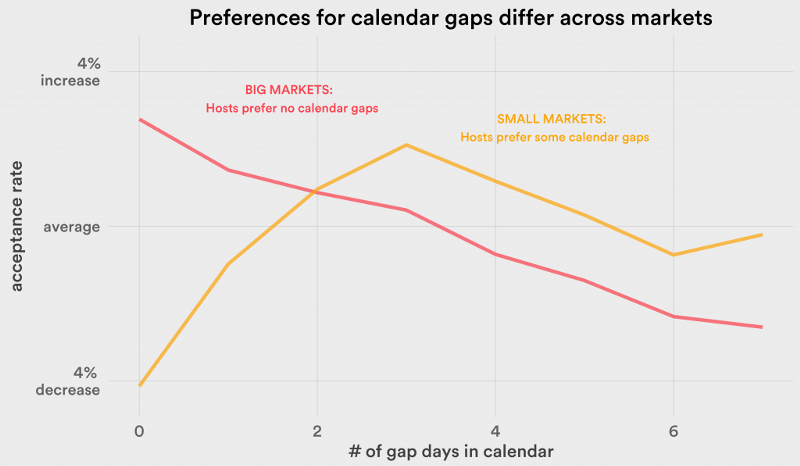

Here is one example that shows you the sophistication that search algorithms move towards.

Airbnb

Have you ever searched for something on an online platform and after spending a few minutes abandoned your search? You may have found something that you liked but one of the details did not match your expectations. Whenever this happens, it is a missed opportunity for the participants and the platform.

Airbnb has noticed that transactions sometimes fail because they don’t fit the host’s preferences for gap days in-between bookings. Based on this insight they have fine-tuned their search algorithms.

The algorithm learns based on previous preferences which type of booking requests different types of hosts are more likely to accept. The search algorithm promotes those more likely to lead to a conversion in the results (e.g. by displaying them higher up in the search results). The analysis has found that hosts in large markets prefer to have as little gap days as possible (whereas those in small markets prefer – or at least not mind – some gaps).

Transaction costs

When search cost reduction helps matching two (or more) parties, lower transaction costs help them to enter an exchange between the two parties. Reducing transaction costs can even be more complex than search costs. I will keep it short at here but more transaction cost examples here.

Airbnb has helped to reduce a lot of the transaction costs that would have put barriers in the way of offering and taking up lodging:

- booking management,

- communication between host and guest,

- secure payment transaction,

- affordable insurance,

- servicing (in some locations),

- safety of transaction via identification,

- reviews of accommodation,

- and more

When comparing the transaction cost reductions among various platforms you will always see some overlaps (rating, payment, communication) and platform-specific ones (see here for more examples).

Strategy

I would love to call this strategic positioning. But this term is taken up by an important concept of good old professor Michael Porter. Well, I could call it “strategic positioning on the demand-supply spectrum”, which would well describe it. But I will refrain from such a convoluted description. So, let’s call it … strategy.

The efforts of developing the platform are often more concentrated on one side. For some platforms this is on the demand side, for others, it is on the supply side. Platforms like Uber and Airbnb have created a whole new supply (sub-)category. Yes, sure, Taxis have long existed. But ride-hailing as such has not. The difference is that a taxi company is a registered business entity. The Uber driver is just an individual providing a commercial ride to a stranger.

Thus, Uber had to expend significant efforts in order to make sure the new supply is safe, complies with laws, is insured, can process payments, locate the passenger and so on. Ooops, does that sound a lot like our transaction cost list from above?

No coincidence here. In economic theory, companies have a competitive advantage against individuals endeavouring the same (yes, economists really wonder about such weirdly-intriguing questions) by internalising most relevant transaction costs (this is where the wider definition of this term comes into play) and leveraging economies of scale on these transactions. Platforms help to reduce the advantage of companies to individuals (or very small entities). This is why I say that Uber’s key achievement is to develop a new supply (sub-)category.

Getting the demand side on board is not cheap. But it involves less efforts (still talking about Uber here). It is largely running some expensive marketing campaigns and providing free ride vouchers. (Cost of customer acquisition, CAC, is the major hurdle for start-ups.)

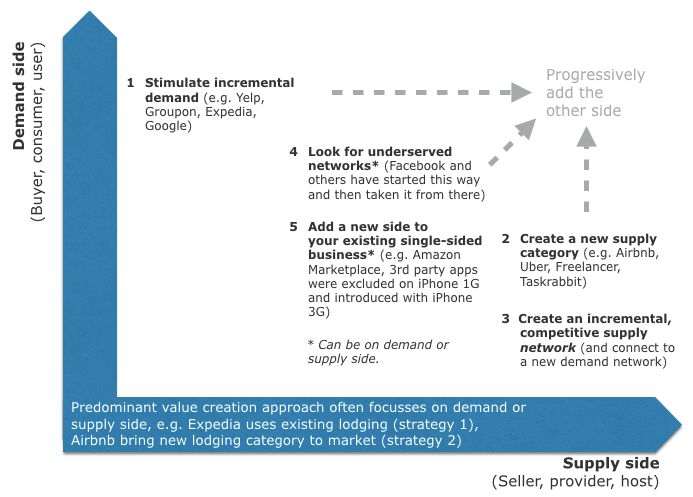

Similar to this example, you can distinguish between a 5 different approaches (and I am happy if you identify more, just let me know):

- Create a new demand network (for an existing supply): Platforms like Yelp, Expedia, Groupon create new demand (or demand network) to an existing supply. Often they do this by aggregating demand through reduction of search costs (e.g. time & effort) on the demand side. They monetise this in different ways. Expedia gets bulk discounts with hotels and then often bundles their offerings with flights. But they are not leveraging network effects as much as other platforms. Yelp creates truly a new demand network. They then offer the supply side (restaurant, shops) enhanced access to this demand network. Note, that these platforms can get started without directly interacting with the supply side. By building a demand network they make themselves very attractive – and unignorable – to the supply side. Search platforms, deals platforms and demand aggregation platforms follow this strategy.

- Create a new supply category: Platforms like Uber, Airbnb, Freelancer, Taskrabbit, first generation game consoles are creating a new supply category. This may be embedded in an existing industry but genuinely deserve the label being a new category of supply. This often requires significant efforts of reducing transaction cost in order to make individuals competitive with larger firms (e.g. hotel) within the same industry.

- Create an incremental, competitive supply network (and connect them to a new demand network): Alibaba has helped many existing small firms in China to connect domestically and internationally to a new demand network. Many of these firms would have had no chance to have an advertising budget to be ever found (=search cost). Many of the actors may have existed before, but the network is new. Equally, no established transaction framework existed. To a certain degree, eBay has done the same. They have connected this to a demand network. Note the difference to strategy 1. Strategy 3 engages heavily the supply side first, whereas strategy 1 does not so. In some cases, strategy 1 almost ignores direct interactions with the supply side until monetisation starts to play a role. The difference to strategy 2 is that strategy 3 starts with an existing supply, e.g. offline stores and online stores that just don’t happen to be able to reach a very wide demand network on their own. As the network grows, previously non-existing players join.

- Look for underserved networks and give them what you feel they are after. Get users on board and then take it from there. This may be on the demand or supply side which is why I have put it into the centre. You may not know what your endgame is but once you have a lot of users, you can monetise access to them in some way. I would add some of the social networks to this as the do not really fit the supply-demand model. They build large user bases for which they charge advertisers for targetted access.

- Add a new side to your existing single-sided business: expand your existing assets and infrastructure to bring a new side onboard. Again, this may be on the demand or supply side which is why I have put it into the centre.

Airbnb has decided to use the approach 2, thereby creating a new supply category. Expedia is in also in the hospitality and lodging industry. But they have chosen approach 1: which is to generate incremental demand and use it for volume discounts. They do not worry about creating new supply themselves. For any given idea, you can play with these fundamentally different options. If you are not sure, you may be able to start with approach 4 and experiment.

We are covering the platform business model and other interesting innovation opportunities in future articles. Sign-up for them at the end of this one.

Getting to critical mass

Critical mass: “The point where the value of the network exceeds the cost of joining for most users. Once a network reaches sufficient size, its network effects start to pull in new users and growth takes off.” [Source: “Modern Monopolies“]

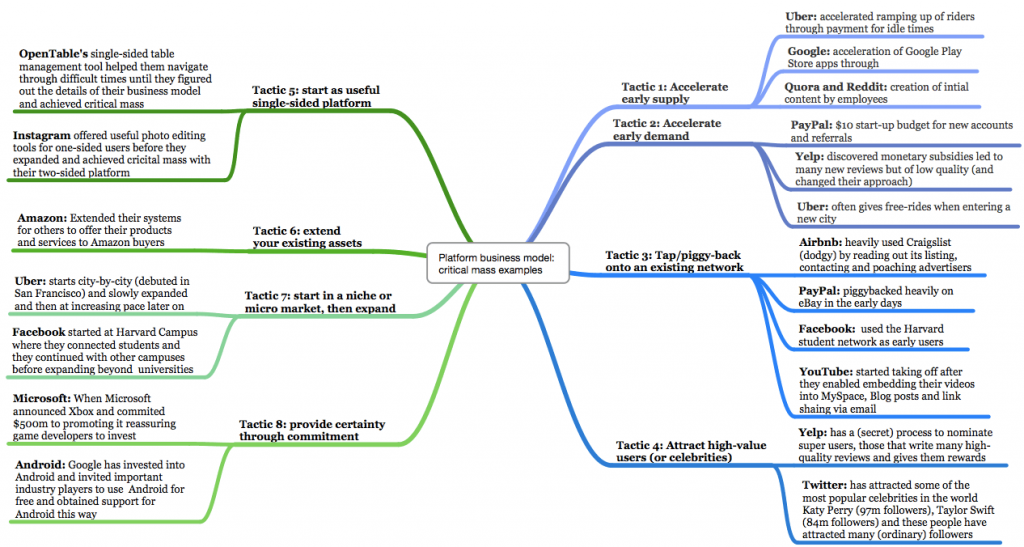

Here 8 tactics that have helped some of the most successful platforms to get to critical mass:

- Tactic 1: Accelerate early supply (with subsidies)

- Tactic 2: Accelerate early demand (with subsidies)

- Tactic 3: Tap/piggy-back onto an existing network

- Tactic 4: Attract high-value users (or celebrities)

- Tactic 5: Start as useful single-sided platform

- Tactic 6: Extend your existing assets

- Tactic 7: start in a niche or micro market, then expand

- Tactic 8: provide certainty through commitment

Some of this seems to be overlapping with the previous section on the overall strategy. But the tactics shown here can be applied at the same time, switched on and off temporarily until critical mass is reached. Uber is a platform business that develops a new supply (sub-)category within the transport industry (called ride-hailing).

But to get to critical mass, Uber uses a number of the above tactics:

- Tactic 4 every time they enter a new city by ‘recruiting’ among previous taxi drivers.

- Tactic 1 by subsidising them in some cases for just being available rather than performing a ride (until demand follows suit).

- Tactic 2 by handing out free-ride vouchers to potential passenger and running free and paid campaigns in the city.

- Tactic 7 by only entering city-by-city (a lesson platforms have learned from OpenTable’s expansion to as many cities as possible from the beginning just to roll back after years of not getting to critical mass).

8 Proven tactics to get your platform business model to critical mass.

Engage!

Network effects need to be actively fostered. It will not be enough to just remove friction. Engaging is essential to keep participants come back to the platform. Having just participants that rarely engage is not sufficient to achieve network effects. Here are some thresholds that platforms have realised are crucial for users staying active on their platform:

- Facebook realised a key engagement driver is for new joiners to find 10 connections within first 14 days. Based on this, Facebook imported contacts from people’s mail, suggested connections and further engaged users with games, media, etc.

- Uber realised a high rate of drop-out rate of driver prior to completing 25 rides. A much-noticed New York Times article described “How Uber Uses Psychological Tricks to Push Its Drivers’ Buttons” to push through this threshold.

- OpenTable has found they need to have at least 25 restaurants to choose from in a given area (suburb-size) to give people enough choices. Based on this insight, OpenTable changed their overall approach. Instead of diluting their efforts across many cities, they retracted from all cities but four and focussed on getting to 25 per relevant area in those 4 cities.

- Medium, Wikipedia, like many other user-generated content platforms, have confirmed the: 1-9-10 Rule: 1% of participants write, 9% edit; 90% read only.

When you start a platform, try to determine what engagement drivers and their critical thresholds.

Design

We have been talking about the platform business model without any technical gobbledygook so far. Big thing! And I am going keep it that way. This doesn’t mean that the technical design details of platforms are unimportant. The technical (and technological) design plays a role. But it is the part that can be copied most quickly.

On our innovation pages, we are not covering technical implementation details. They would already by obsolete by the time I would publish them. There is more value looking at the principles behind. These stay relevant much longer and can be transferred to your technical area much better.

Technologies play a role. But not as big as tech magazines suggest. There is little correlation between the first inventor of a particular platform and who takes the longer-term victory on that technology platform. Facebook was not the first social platform, Uber was not the first ride-hailing platform, Google was not the first search platform. And the list could add all companies mentioned in this article. None of them was the first in their category.

Opening up your platform to integration of 3rd party elements will be one of the most critical design decisions. But it is not really a yes/no decision. I have explained in great detail here and here, that preventing collaborative innovation will often lose big time. The decision thus will often be to which degree, what and how.

Because on the other end of the spectrum, governing the platform to reduce negative network effects plays a very big role. Opening too widely, to the wrong parties or in the wrong way invites havoc. And that to a degree that will bring the platform down. If this wasn’t exactly what you expected in the “design” section, check out the links mentioned for more details. It will make a lot of sense.

Revenue models

What can go wrong when the monetisation is set up poorly? Ask Mr Rupert Murdoch. In 2006 he bought an already floundering MySpace (previously the web page with the highest annual traffic). He promised dramatic monetisation targets (10-folding previous revenues) to his shareholders. It ended up being what a senior MySpace manager called “the last nail in the coffin“. The platform lost ground to Facebook and is now a minor player in the platform universe.

Here are your 4 options to monetise according to Prof Parker et al.:

- Charging a transaction fee: whenever monetary exchange is involved in the transaction between the participants, charging a transaction fee is a viable approach. This can be a fixed fee depending on the type of transaction. Or it can be a certain percentage of the transaction value. Uber and Airbnb apply the later. And given most their payments go through the platform, it is quite invisible to the participants. This approach can discourage transaction when the transaction size is large. If you ask for a large project through Freelancer, a 10% transaction fee can incentivise participants to take their transactions outside of the platform. Same applies to many service platforms where the parties interact with each other closely (either online or face-to-face during the transaction). Less so in Uber where the benefit is to utilise the nearest driver upon very short notice. Trying to prevent communication prior to the transaction was one of the reasons for eBay’s struggled in China (among other factors) with unfavorable outcomes for eBay. And it was one of the reasons why Alibaba chose a different monetisation approach.

- Charging for access: LinkedIn doesn’t charge individuals anything (in the basic access). But it does charge recruiters who want to use the platform for job advertising/recruiting. This form of monetisation is charging for access to an audience. Dating sites often do the same.

- Charging for enhanced access: Many social media platforms allow companies access to their audience. But even large companies get lost in the amount of interaction on the platform. To get through to a targetted audience, these platforms (e.g. Facebook, Yelp, Twitter, Google), charge for standing out in the crowd. For advertising companies, this has some benefits compared to traditional broadcast advertising that gets displayed to a lot of irrelevant audience. These platforms charge for enhanced access to relevant audiences.

- Charging for enhanced curation: Lynda.com and Skillshare.com offer access to high-quality courses (so at least ambition), for a monthly subscription fee. You can go online and find lots of good free courses (Khanacademy) as well as paid ones. And there are great ones among them. But you might search for a long time. And also risk coming across high-paid, low-quality stuff. This monetisation model charges for access to higher value curation.

Monetisation is more complex than this and I am explaining this in more detail using Uber’s revenue model as and example as well as Airbnb’s revenue model.

The platform business model – an amazing opportunity

This was our summary of our previous 5 articles on the platform business model. Everything at one sight.

It also added some new insights.

Was it long? Yes, my aim is to provide you content that will genuinely make a difference in your endeavours to learn about innovation. You may use it to come up with your own idea or to work in a team on such ideas. Maybe you are already part of an innovation/strategy team working on a platform idea.

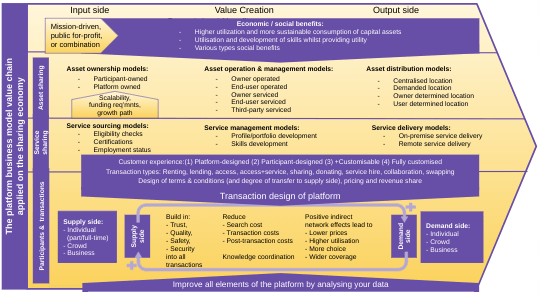

The plaform business model value chain

If you liked this article, then also check out my article how the platform business model fuels the sharing economy. It uses one of the most popular strategy tools, the value chain, to describe how the platform business model can be used in practical terms.