Business models compared: Booking.com, Expedia, TripAdvisor

The travel industry is an excellent example of how forcefully platform businesses can enter a fragmented supply side environment composed of thousands of hotels, airlines and distribution systems. The biggest players (by market capitalisation) within the $1.3 trillion industry were established companies, like the Marriotts, Hiltons, Delta Airlines.

Within a mere two decades the successful platforms – Priceline and Expedia – have left these century-old giants behind. Compare the biggest players by market cap (August 2017):

- Priceline: $98b; employees: 18,500

- Expedia: $21b; employees: 18,500

- Marriott: $41b; employees: 226,500

- Hilton: $22b; employees: 164,000

- Delta Airlines: $35b; employees: 80,000

- Southwest: $33b; employees: 55,000

Today, we are going to look at the Online Travel Agencies (OTAs):

- Booking.com (fully owned by Priceline),

- Expedia and

- TripAdvisor

to understand their business models and to deepen our understanding of platform business models.

Platform business model

Previously, I have covered how the platform business models work in detail and in many articles. I have also explained in depth the very successful platform businesses:

Three business models

There are three predominant business models used by the Online Travel Agencies (OTAs), the advertising, the agency and the merchant business model. Each of the three companies has their predominant revenue stream in one of those:

- Advertising business model: TripAdvisor

- Agency business model: Booking.com

- Merchant business model: Expedia

The great news is that these business models can well be used by other, non-travel industry platform businesses. Broadly speaking, all three businesses are demand aggregation platforms. These type of businesses have excellent prospects in highly fragmented industries. And more broadly yet, we can apply these business models to comparison / meta search / demand aggregation sites businesses in general.

Business model TripAdvisor

The most common reason people use TripAdvisor is for decision making and planning of their vacation. An important part of this includes finding the right hotel which is generally the most expensive item of a vacation.

- Click-Based advertising

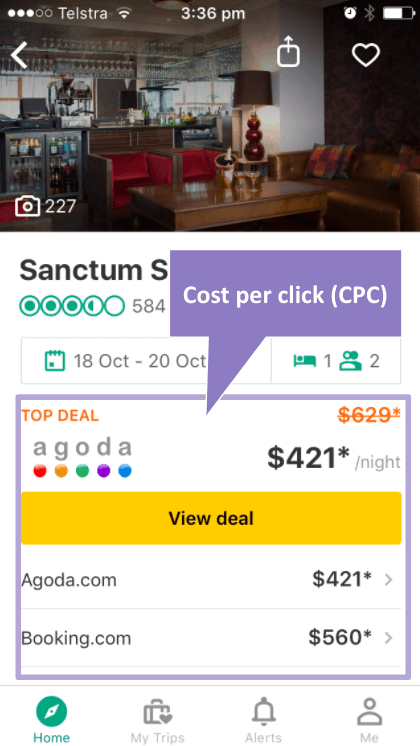

- Travellers first use TripAdvisor prior booking their trip. TripAdvisor will display hotels that deem most suited to the user’s query in an overview list.

- It gets more interesting after the user clicks to one of the hotel pages to research it in more detail, by reading what other travellers wrote about this hotel.

- TripAdvisor will display clickable buttons that lead to a booking page for that hotel through the advertiser. These are cost-per-click (CPC) advertisements. The advertiser will pay only if the user clicks on the link which will lead them to the advertiser’s page away from TripAdvisor.

As I research hotels through the reviews others have left, I will see prices for this accommodation through various other platforms. Once I click one of those TripAdvisor will receive a CPC fee. - Tripadvisor will get paid for each click regardless if it leads to a booking or not. The recipient gets a lead. Such a click may cost more than a click directly from Google (and in some cases not). A higher fee would be warranted as the user is further advanced in their booking intent compared to a Google search. This is why you will find Booking.com and Expedia advertising heavily on TripAdvisor, making it 46% of TripAdvisor’s total revenues.

- The cost of the click is determined in an auction system. But they would typically be in the sub-dollar to a few-dollar region (make it up to a low double-digit amount). There will be very strong variations between bidding for say a 2-star hotel in a remote area and a luxury hotel in Manhattan.

- In the snippet above you see Agoda and Booking.com who are both fully-owned by Priceline. Once the user clicks one of the other OTA’s links, they will end up on that OTA’s page. Some OTA’s (e.g. Booking.com) will lead you to their hotel overview page for that city with the chosen hotel at the top and other hotels directly following. Other OTAs will lead you directly to the OTA’s booking page for that hotel. This says a lot about the

OTAs chances to get conversions (i.e. sales on one or the other type of page). The choice is clearly the result of many experiments with significant sample sizes. - Popular hotels often have over 10 advertisers listing their links. Other bidders are the respective hotels themselves.

- If you are not particularly familiar with this industry, you might find it “ironic” that hotel owners would need to join the auction to have a link to their hotel reservation pages listed in this list. And it is not even easy to do so, let alone to be listed up the top against the marketing giants, the OTAs.

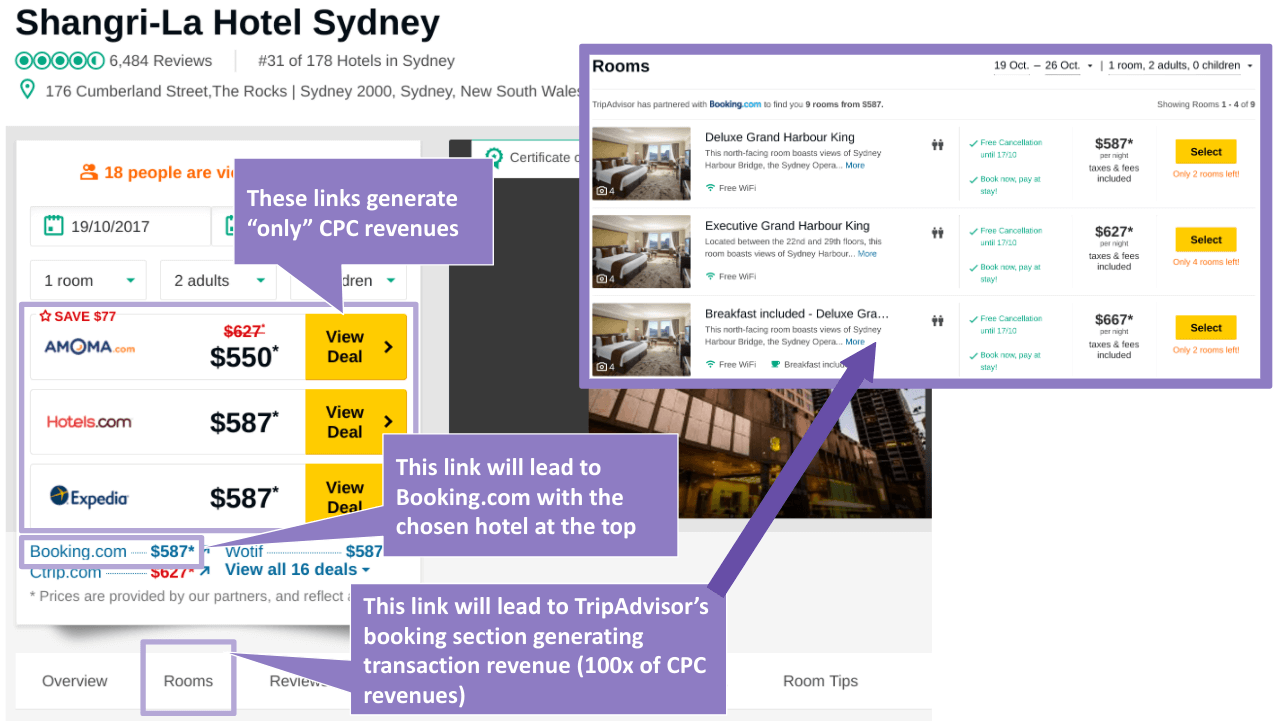

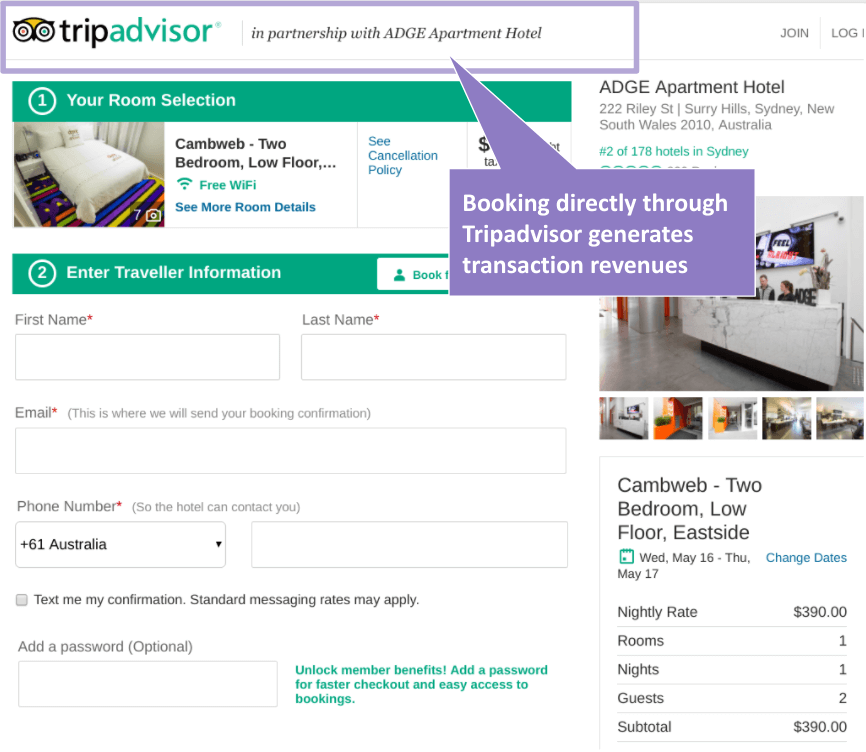

- Transaction revenue

- Transaction revenues are generated through direct bookings on the TripAdvisor pages / app. This type of revenue is more valuable for TripAdvisor as it gives them a 12%-15% commission on the booking price which far exceeds click-based revenue (but occurs less frequently). This will be typically in the few hundred dollar region, thus a probably 10x-100x higher than a single CPC revenue.

TripAdvisor’s CPC and transaction revenue models are on the same page. TripAdvisor ranks the link to their own transaction revenue lower than other OTA’s links in order to provide the best price to their customers and to fulfil their contracts to list the combination of lowest price, highest auction bid and quality score at the top. - TripAdvisor (TRIP) has entered contracts with most of the leading global hotel chains for this purpose, such as Accor, Best Western, Hyatt, Marriott, Hilton, Wyndham and others. But also their competitors Expedia and Priceline (Booking.com) have entered such agreements. TRIP has now over 500k directly-bookable hotels in their inventory.

TripAdvisor (TRIP) has been able to sign-up its competitors and many large hotels chains to their direct booking system directly through the TripAdvisor pages/app. - The structure of the TripAdvisor hotel pages tells a clear story about gradual shift their business model:

- Above the fold (see the second last image), you will see pictures of the hotel and the CPC advertising buttons.

- Next, follows the hotel overview section with more details on the selected hotel and links to similar hotels.

- Third, comes the section where you can book a hotel directly through TripAdvisor (TRIP), i.e. generating transaction revenues. This section only exists for the hotels that can be booked through TRIP (generating transaction revenues).

- The reviews section comes only at fourth place. This is TRIP’s core identity, the value proposition that made them what they are. But it is also the section that doesn’t generates a high amount of short-term economic benefits. It generates significant long-term economic benefits as it is the key contributor to ranking very high on Google’s organic search results (i.e. free traffic).

- Transaction revenues are generated through direct bookings on the TripAdvisor pages / app. This type of revenue is more valuable for TripAdvisor as it gives them a 12%-15% commission on the booking price which far exceeds click-based revenue (but occurs less frequently). This will be typically in the few hundred dollar region, thus a probably 10x-100x higher than a single CPC revenue.

- Display-based advertising

- You can try find fancy words for it, but basically these are the ugly, old banner ads. The pricing model is a cost-per-impression or more commonly called cost-per-mille (CPM), the cost per 1,000 impressions.

- Advertisers are typically hotels, airlines, cruises, tourism organisations, suppliers, and so on.

- Follow ads that follow users based on cookie data has given these form of ads a better use case than unsolicited, random displays.

- Subscription-based advertising

- TripAdvisor will add as many hotels, restaurants, attractions, etc as possible to their databases. But the owner can only edit the profile, make special offers, list preferred contact methods, mail address, phone numbers, etc when they subscribe.

- Subscription-based advertising is a contract for a period of time. For small Bed & Breakfasts this comes at a few hundred dollars per year.

- If you find this sounds like what Yelp does, then you are not mistaken.

Tripadvisor’s annual report 2016 (page 39) shows the composition of their revenues:

- Click-based advertising (CPC) & transaction revenues: $750m / $1.2b = 63%

- Display-based advertising (CPM) & subscription: $282m / $1.2b = 23.7%

- Other hotel revenues: $158m / $1.2b = 13.3%

It would be interesting to see how much TripAdvisor makes through transactions. But they lump it together with the CPC revenues. We can be certain that well over 80% of these revenues come from CPC advertising from past annual reports.

How to grow?

TripAdvisor will undoubtedly try to grow its transaction revenues. But that might morph them into a booking website and risk losing their identity of being a trusted adviser. The adviser business is less lucrative as it is too early in the human action process (intention generation) when the big revenues are in the booking decision (intention harvesting).

TripAdvisor (TRIP) would lose significant economic benefits by morphing into another booking site. They would start ranking lower in the organic search results on Google and other general search engines. This is a significant source of free traffic to TRIP pages. They may become a smaller version of Booking.com and thus start an uphill battle. The answer to the right course will be found through lots of experimentation.

Business model Booking.com / Priceline

Booking.com is wholly owned by the Priceline Group. They are a different kettle of fish with a market cap is around $99b (as at early August 2017) and annual revenues of ~$11b, some 10x larger than Tripadvisor.

The majority of Priceline’s revenues come from Booking.com using the agency business model:

- Agency business model: $7.98b/$10.7b = 74%

- Merchant business model: $2b/$10.7b = 19%

- Advertising and other revenues = 6.6%.

The agency business model

- Revenue model

- The agency model uses the same revenue model as the good old brick-and-mortar travel agency: commissions.

- Booking.com has contracts with the hotels that it lists and will take a commission on each booking through its site between 10%-30%. The commission depends on the size of the hotel and how well it wants to rank on the Bookings.com pages.

- Booking.com will display hotels taking into account the best interest of:

- the user,

- the hotels it has contracts with and

- itself.

- This is a key difference between Booking.com and TripAdvisor. In Booking.com hotels pay for ranking higher with a higher commission. As mentioned above, these are much higher costs than CPC-ads. The difference to CPC ads is that the hotels pay only for successful bookings not for driving traffic to their page.

- Joining the preferred program is an additional way to get more traffic again paid for with higher commissions.

- Offering hotel rooms on a commission basis has the benefit of not owning the inventory (hotel rooms) and thus not having cash tied as well as not carrying the unsold inventory risk.

- Customer acquisition

- $2.7 billion in performance advertising in 2015 (annual report, pg 51) for advertising on Google, other search engines, on travel sites like TripAdvisor and other digital advertising. An additional $273m for brand advertising, e.g. TV.

- An inherent characteristic of the hotel industry is that most people use the same hotel either only once or only a few times in their life. This is particularly the case for independent hotels.

- Online travel agencies (OTAs) don’t need to worry which of one of the hotels the user books. They make their commission either way. Thus they can pay much more for their advertising on Google than any individual hotel or even large hotel chains can pay.

- You can check this for yourself. Search on Google for a hotel in your preferred destination and see who ranks on top on the Google ads. Do the same on TripAdvisor and see who ranks on top on the respective hotel pages. You will in most cases see an OTA because they bid higher in the auctions. And the reason they can do this is because a click has higher average economic benefit for the OTA than for the hotel. More on this in later.

- In essence, Booking.com has better economies of scale in their customer acquisition than hotels.

- This is one of the key reasons why platforms have excellent chances to enter industries with highly fragmented supply sides – even if the supply side has some very large players in it.

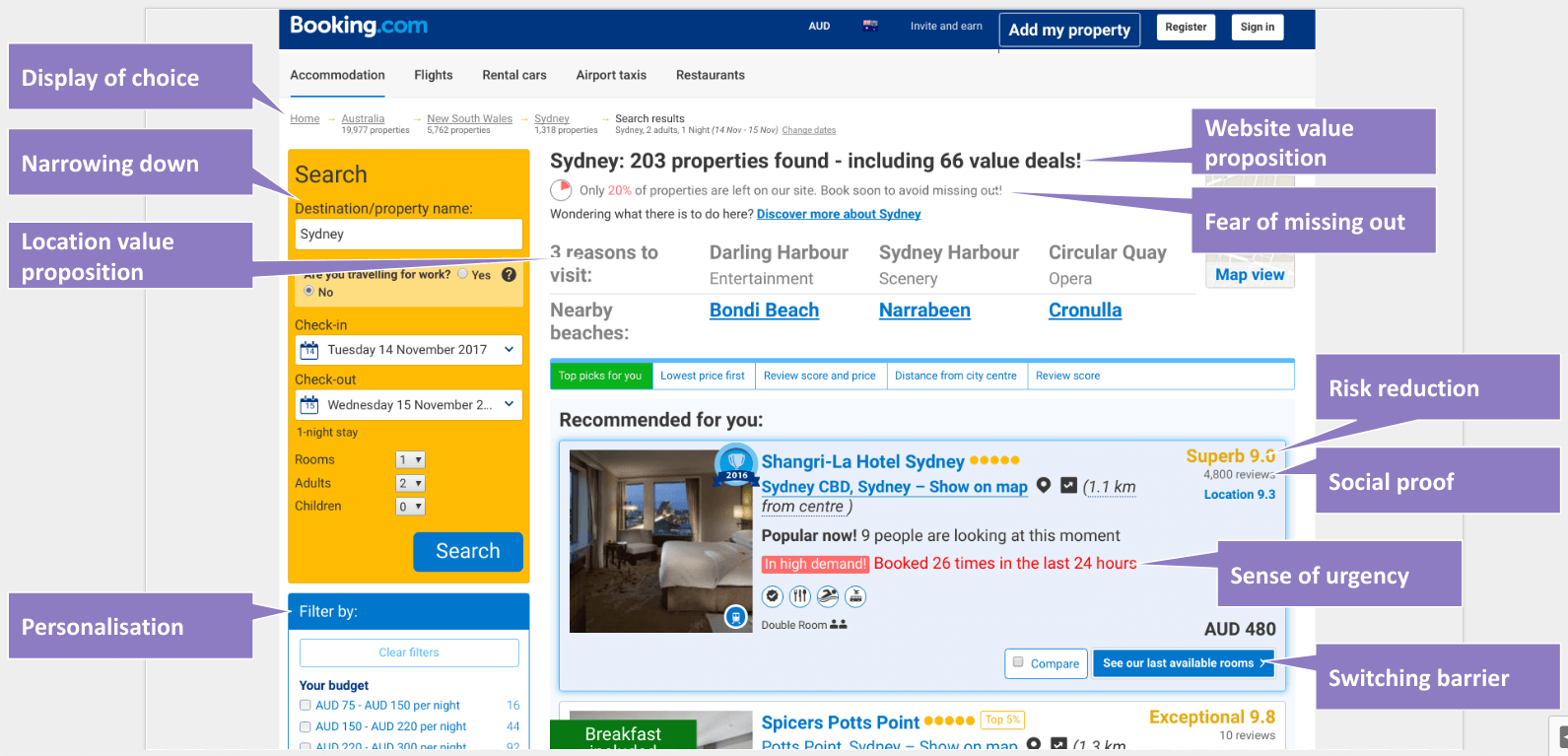

- Customer value proposition

- Cheapest prices: Booking.com has contracts in place with the hotels that it lists. One of the clauses, called rate parity, is that the hotels can’t offer the same (type of) room at a cheaper rate on the hotel’s web pages. And if they do so they have to match it on Booking.com. Without such a rule, users could choose a hotel on Booking.com but then complete the booking on the hotel’s pages.

- Amount of choice: Booking.com has now over 1 million places to stay in their database and a large amount of filtering options that make it easier for the user to find what they are after.

- Useful and persuasive content: a vast amount of pictures and useful reviews created by other users.

- Reduction of risk: the star rating and reviews generated by other users reduce the risk of being disappointed.

- Technological lead

- Let’s be honest. Booking.com is a killer sales website providing a great user experience and teasing emotional reactions combined with a deep infrastructure linking to the vast array of hotel distribution systems. Every year Booking.com/Priceline spend upwards of $100m to further enhance their technology.

- Look at the website elements below. Then choose your favourite hotel chain and go to their booking pages. You will note that the latter is almost just a transactions form than an actual sales page that is trying to persuade.

The Booking.com site is one of (if not the) best online sales web pages. It is full of persuasive elements to close the deal. It also is an object of study for web user experience (UX) designers. (Click the image for a larger version.)

This business model qualifies as a true platform business model as the platform (Booking.com) does not own (not even for a temporarily) the inventory (being hotel rooms or apartments). They are a travel marketplace that offers the participating hotels better sales opportunities than any other marketplace online.

Business model Expedia

The last business model we are going to look at is the merchant business model. Expedia makes the majority of its revenues through this model.

Expedia’s revenue (2015 full year results, page 59) by business model:

- Merchant: $4.2b / $6.7b = 63%

- Agency: $1.9b / $6.7b = 28%

- Advertising: $0.57b / $6.7b = 8%

Merchant business model

- In this business model, the platform buys hotel rooms and then resells them to travellers. The merchant gets the rooms cheaper by buying the rooms very early as well as in bulk. Often, the merchant bundles them with airfares, rental cars and/or other things.

- Here is an example from Investopedia: “Expedia wants to offer seven-night, all-inclusive vacations for two in Jamaica. The travel company contacts a hotel in Jamaica and asks to buy a block of 100 rooms at $50 a piece instead of their Best Available Rate (BAR) of $90. Expedia then contacts airlines and makes 200 seat reservations to Jamaica for $600 (with little or no discount). The package is offered to guests at a cost of $1,700 for two people. People booking on Expedia are happy; they have saved $130 off the list price just by booking with Expedia! Expedia shareholders are happy because they have only paid $1,550 for a package that they have sold to 100 couples for $1,700. Everyone wins.” (in reality, not everyone won – there was lots of industry pushback on Expedia. Moreover, once in a dominant position, Expedia managed to include a return clause into many contracts that allowed them unsold rooms to be returned to the hotel 24-hours prior the due date).

- Cash flow timings are different to the agency model. In the merchant model, the business has to fork out the cash upfront. Nominally, they sit on the risk of not being able to sell all their inventory. However, with their increasing power Expedia have managed to negotiate that they can hand back the room to the hotel 24 hours prior if they can not sell it. This has tilted the deal much in favour of Expedia (but whether or not this clause applies on all room/hotels, I doubt).

- When it started, this model was cash flow advantageous. The OTA collected the payment from the customer at the time of the booking which may be well in advance of the actual travel. More recently, travellers can pay after their stay.

- The merchant model also allows individual hotel bookings. But the package deals are more attractive to those who don’t want to research flights, accommodation and other things separately. On Expedia, you are more likely to buy an entire vacation rather than individual pieces.

- Initially, the merchant business model was considered superior but over the years Booking.com owner Priceline demonstrated faster growth.

- Like Booking.com, Expedia invests heavily into their technology, e.g. $686m in 2014alone.

- Marketing expenses are comparable to Priceline at $2.8b in 2015.

In a strict definition, I would argue that the business model is not a platform business model as the business buys the inventory. But it is an important one in this industry so I did want you to be aware of this business model.

A tug-of-war

Priceline and Expedia have become the biggest players in the travel industry. Priceline is the single biggest player by market cap. As you would expect, hotels are asking why these players are getting such a large share of the profits when it is the hotels (and airlines) who do the most of the heavy lifting.

An intensifying tug-of-war between the hotels and the OTAs is unfolding. Here are some of the most important developments over the last few years. You can see that most of them don’t occur in the technology space.

No longer the cheapest price?

The biggest selling point for the OTAs is that they will offer the cheapest price for the hotels you can find on their site. The OTAs secure the cheapest price through rate parity clauses.

- It basically obliges the hotel to not offer lower rates for the same type of room on their web pages than they do on the OTA’s pages.

- Hoteliers report that when they offer discounts on their own pages, they will receive an email from Booking.com within an hour asking to make the same rate available on their pages.

- Hoteliers have found this to be too restrictive and challenged it in court.

- In some countries, including France and Germany, rate parity clauses been banned.In the US rate parity clauses have been upheld, a victory for the OTAs. In other countries, the decision is still pending.

“Stop clicking around!”

Hilton challenged the previous arrangements and negotiated lower commissions and concessions with the OTAs. They are now able to provide additional rewards through their loyalty program. Ramping up their efforts against the OTAs and getting more direct bookings on their own web pages, Hilton started an ad campaign “stop clicking around.” Its key elements are:

- The promise that customers will get the cheapest Hilton rates on the Hilton pages through their loyalty programs that are not available through the OTAs.

- The promise of a more personalised experience.

- Marriott’s has started their own “It Pays to Book Direct” campaign and promised that if a guest finds a lower rate elsewhere within 24 hours, they will match the price and take an additional 25% off.

Increasing competition on side of the platforms?

- Marriott’s has taken up TripAdvisor’s direct booking facility which comes at a lower commission (it is in the range of 12%-15%).

- Many others have followed suit (Accor, Wyndham, Hyatt, Best Western, etc).

- But Expedia and Booking.com are TripAdvisor’s biggest advertisers and a recent slump in auction bidding revenues has purportedly been caused by the big two moving out some ad dollars from TripAdvisor.

The pushback

Those hotel chains that “play well with us” will build great partnerships, and those that don’t will risk losing share and audience on Expedia sites, said Expedia CEO Dara Khosrowshahi (who in the meantime has become the new CEO of Uber).

- “Expedia was saying, ‘If you don’t give us your most competitive rates, there are other hotels that will, and those hotels are going to win more market share,’”

- “What Expedia initially did was take the big chain hotels and push them way low in the listings so that you couldn’t find them. If a hotel is not in the first five or six search results, it might as well be in Oshkosh.”

- OTAs have also fought back through a practice known as “dimming” — stripping out images, review ratings and descriptive copy — to make properties less attractive to consumers.

- “Right now,” said Schaal, “the big hotel chains are in a position of strength. Rooms are full, rates are good and they’re winning share by offering lower rates through their loyalty programs.

- And notes this may change when the economic circumstances change.

The final arbitrator – the president?

- Skift, an industry magazine, reports, “The U.S. hotel industry plans to step up a lobbying and public relations attack on Expedia Inc. and Priceline Group Inc., hoping to convince consumers and members of the Trump administration that the travel-booking giants are monopolistic. The trade group intends to lobby Federal Trade Commission officials on the issue and try to ensure that new members picked by President Donald Trump are friendly to hotels, according to the documents prepared for a January meeting of the group’s board. […] “The Expedia and Priceline duopoly hurts consumer choice and the small businesses in our industry, which represent some 60 percent of all hotels in the U.S., who are struggling to compete as a result of the gouging commission rates””

- The OTAs will take these efforts very serious given it is driven by the politically very well-connected American Hotel & Lodging Association. This is the same lobbying group that has found to have been pulling the strings against Airbnb recently.

Roomkey: a new platform

And last but not least, some of the largest hoel chains have joined forces and created their own booking platform Roomkey with the key value proposition of “Did you know: Many hotel chains offer lower rates to members of their loyalty programs through their own websites? Now Room Key can access these low Loyalty Member Rates for thousands of hotels across more than 60 hotel chains – more than any other travel site – making it easy to shop the best rate.”

It will be interesting to see whether or not this site will harm the OTAs. A cursory look at this platform shows it has good inventory in large US cities but abroad it is in the infant stage, i.e. not too many listings at this stage. This is an ample way to get started.

Why does the business model work?

All three business models that I have described here work for one key reason with the agency model being the strongest one: They leverage demand-side economies of scale by scaling up the customer acquisition and providing a great user experience. The majority of traffic, ie.e demand, comes through other websites and Google is by far biggest one.

No hotel or hotel chain can afford to bid as high for a click in Google as Booking.com (or Expedia) can. The hotels’ conversion rates will never be as high as a demand aggregator page. There are several reasons for this:

- Any user coming to a hotel page through a paid link from Google would check out the hotel’s offers, then hit the back button and research another hotel. Thus, the hotel pays for CPC ads that are much less likely to convert. The more hotels the user checks out prior booking, the less likely any individual hotel’s chances to convert – not so with the OTAs.

- The basic premise of conversion_rate * commission_earned > CPC_Google is much easier to achieve for the OTAs.

- The OTA’s pages do provide a customer proposition that the hotel’s pages by definition don’t: they provide a comparison by price, no individual hotel can do this (Roomkey.com might).

- The OTA pages also offer reviews and user-generated content which the hotel pages do not have. Room key uses a short excerpt of three reviews from TripAdvisor and a link to more reviews there.

- And last but not least, the OTAs are super-optimised sales pages.

And of course, Google i snot standing still. They have entered the multi-billion dollar hotel advertising business as well and now becoming a big player in this space themselves.

It is definitely an interesting space to watch.

Irrespective if you are in the travel industry or a different one, there are a lot ideas in this article that you can use elements of for your own platform business model innovation.